I recently stumbled upon information regarding a privacy lawsuit involving Plaid, a fin-tech entity.

Plaid is a company that provides technology services to about 5,000 mobile and web-based apps, helping users connect their bank accounts to these apps.

However, some issues arose concerning Plaid’s data practices and they faced a class-action lawsuit due to allegations of improper actions related to this process.

So, in this article I’ll break down the Plaid privacy litigation so we’re all better equipped to recognize privacy violations – especially in the financial sector – going forward.

Table of Contents

Plaid’s Privacy Litigation Overview

The litigation claimed that Plaid obtained and used customers’ bank account credentials and financial information. This raised concerns about how our personal data is being handled in the fintech industry. Good news is that a settlement has been proposed in this case. To address these concerns, Plaid agreed to pay a sum of $58 million.

The settlement brings forward some important questions about data privacy, especially within the fintech sector, and how services like Plaid can potentially affect their users’ privacy rights.

So, as someone who uses digital platforms to manage my finances, I’ll definitely be paying more attention to the privacy policies of these services moving forward.

Cause of Litigation

The main concern in this litigation is the alleged improper handling of user’s sensitive financial data by Plaid.

It’s been claimed that they obtained and used consumers’ banking account credentials without their proper consent and that they obtained more financial data than was needed by a user’s app.

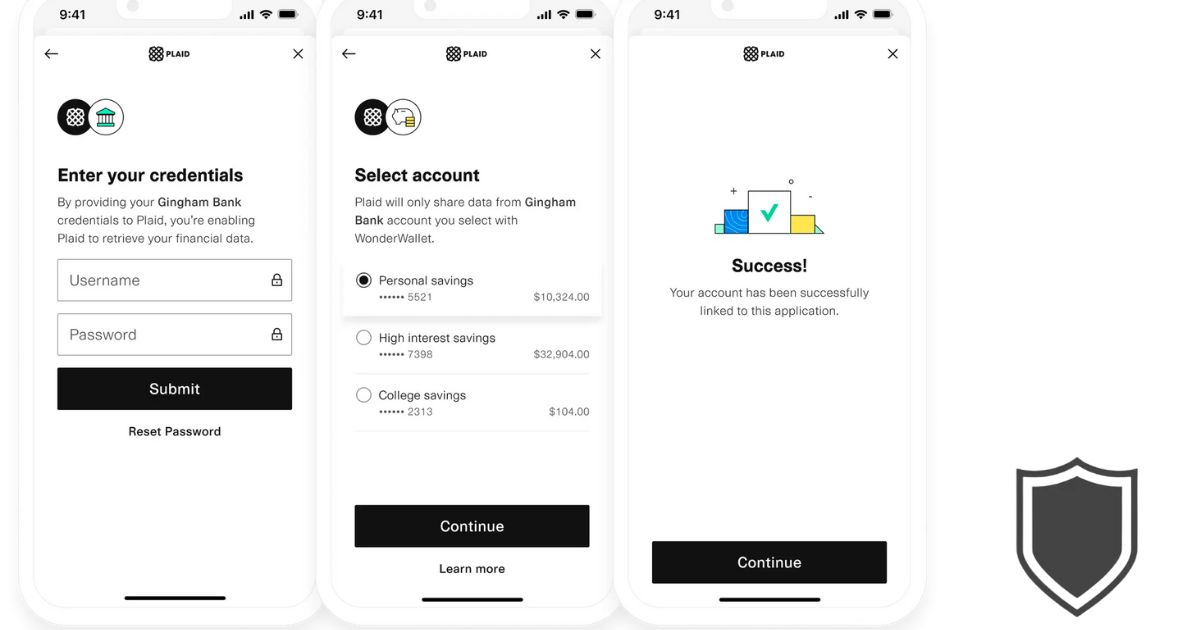

They were also accused of acquiring user’s login credentials through their user interface known as “Plaid Link” which resembles a user’s own bank account login screen.

As a result, a class action lawsuit was filed against the company, which eventually led to a proposed settlement.

In an effort to address these concerns, Plaid has agreed to change a number of its privacy and data collection practices, at least for the upcoming three years in the United States.

These changes include commitments to delete certain financial data and improve disclosures of their data practices, as stated in their settlement agreement.

Apart from these adjustments, the company has also agreed to pay a sum of $58 million to resolve the claims raised by consumers in this case.

Players Involved

As I was researching the Plaid Privacy Litigation, I learned about the various entities and individuals involved in the case.

To start, let me introduce you to the fintech company Plaid Inc., who serves as the defendant in the class-action lawsuit.

Plaid provides a platform that enables users to connect approximately 5,000 mobile and web-based applications to their bank accounts, making it a key player in the fintech ecosystem.

Despite its widespread use, Plaid found itself in hot water when it faced allegations of mishandling their users’ sensitive financial information.

The lawsuit was filed by a group of plaintiffs who claimed that Plaid had improperly collected and handled their financial data.

The legal team representing the plaintiffs included Rachel Geman of Lieff Cabraser Heimann & Bernstein, and Christopher Cormier of Burns Charest, who worked diligently to ensure the best possible outcome for the affected class members.

But, it’s not just about the company and the plaintiffs.

This lawsuit also affected millions of end-users who engaged with the various apps that rely on Plaid’s services.

In fact, many users received notifications about the settlement and had the option to check their eligibility for receiving a payout from the $58 million settlement.

To ensure fairness and transparency, the Settlement Administrator played an essential role in the process, providing support and communication to the class members involved in the lawsuit.

Plaid’s Response to Litigation

To address these concerns, Plaid agreed to pay a $58 million settlement to resolve the privacy case.

This was a significant decision made by the company, and it showcases their commitment to addressing user privacy concerns.

Throughout the litigation process, Plaid was represented by the Cooley law firm.

The settlement reached in August 2021, not only included the monetary compensation, but also injunctive relief aimed at alleviating the issues raised in the case.

As a result of the settlement, Plaid’s focus seems to have shifted towards ensuring user privacy and addressing concerns to provide a more secure and transparent experience for users moving forward.

This is an important development in the fintech industry, as it sets a precedent for other companies in the space.

Legal Implications and Precedents

As I’ve been looking into the Plaid privacy litigation case, there are a few interesting legal implications and precedents that I’d like to share.

Comparisons with Past Litigations

This case is not the first of its kind, as there have been other legal actions taken against companies handling user data inappropriately.

In the past, several significant settlements have involved similar issues around data privacy. For instance, the Equifax data breach resulted in the company reaching a $700 million settlement back in 2019.

Another similar case happened with Facebook, which settled a class-action lawsuit for $650 million in 2021 for collecting biometric data from users without their consent.

These past litigations emphasize the increasing expectation for companies to protect their users’ privacy and establish a legal precedent for similar cases in the future.

As a result, I believe that the Plaid case serves as a reminder to organizations handling sensitive data about the importance of implementing robust security measures and being transparent with their users.

Impact on User Privacy

As part of the $58 million settlement, Plaid agreed to make significant changes to their business practices, improving user control over private login information and financial data.

These changes will not only increase transparency but also ensure users’ online privacy is better protected.

For instance, Plaid has committed to deleting certain financial data that is no longer needed for providing its services.

This step is vital in reducing any potential privacy risks or unauthorized use of user information.

Moreover, I believe this settlement sets a positive example for other fintech companies to evaluate their data collection and privacy practices actively.

It highlights the importance of responsibly handling sensitive financial information and the potential legal repercussions of neglecting user privacy.

Potential Future Consequences

As I take a closer look at the Plaid privacy litigation, I believe there could be a few potential future consequences worth exploring.

For one thing, the $58 million settlement sets a precedent for similar data privacy cases involving fintech companies.

This may lead to more stringent regulations in the fintech sector, as well as foster greater awareness about data privacy rights among users.

Given that Plaid had allegedly breached users’ privacy while connecting their bank accounts to various payment apps, there could arise an increased demand for transparency in data handling practices.

As a result, I expect technology companies to prioritize user privacy and invest more in securing their customers’ data. In turn, this could lead to the development of better and more secure financial services platforms.

Additionally, the large settlement may serve as a stern warning towards other fintech companies.

It is likely that the industry will now give higher consideration to privacy concerns when developing and adapting software or platforms.

Consequently, we might observe more proactive measures taken to identify and remediate any potential vulnerabilities in their systems.

Industry Reaction

It’s clear that the settlement has garnered a lot of attention.

Many companies and professionals are reviewing their own data privacy policies and practices, considering the implications of the Plaid settlement for their operations.

In the fintech sector, organizations are paying particular attention to this case.

They’re taking a close look at how they handle their users’ data and how transparent they are about the use of that data.

This has led to many businesses discussing data privacy best practices and ensuring that their practices are compliant with applicable regulations.

Though the settlement might seem quite hefty, some industry insiders actually appreciate Plaid’s responsiveness and willingness to address the privacy concerns.

Their decision to pay the settlement and resolve the issue has been seen as a positive move, showing a commitment to prioritizing users’ privacy rights and addressing any potential shortcomings head-on.

In addition, this case has sparked conversations about the need for more clarity when it comes to data privacy in the tech industry as a whole.

Many companies are now being proactive in making sure their users have a clear understanding of how their data is being used, stored, and shared.

The Final Word

In the intricate dance of data use and user trust, the Plaid privacy litigation highlights the fragile balance companies must navigate.

This case serves as a cautionary tale, underscoring the paramount importance of transparency and user consent in the digital age.

The implications resonate far beyond Plaid, reminding all tech entities that with great data comes great responsibility.

The outcome may well set a precedent, shaping the future of digital privacy and reinforcing the rights of users to control their personal information.

For now, we watch, we learn, and we continue to question—who really holds the keys to our digital lives?

Plaid Privacy Litigation FAQs

What is the outcome of Plaid settlement?

The Plaid settlement resulted in a payment of $58 million to users and customers of Plaid Inc. The legal proceedings took place in the United States District Court for the Northern District of California, under Case No. 4:20-md-03056 in a privacy litigation.

How does the Plaid settlement affect privacy?

The Plaid settlement’s primary aim was to address concerns about Plaid’s handling of user data and privacy violations. It serves as a reminder for technology companies dealing with financial data to prioritize privacy and data security. While I don’t have direct information on how Plaid’s data handling practices have changed, the settlement can be seen as a step towards better privacy standards in the tech industry.

What were the key issues in the Plaid lawsuit?

The key issues in the Plaid lawsuit revolved around alleged privacy violations and unauthorized access to financial data. The plaintiffs claimed that the company had collected and used sensitive financial information without proper consent from users. This privacy litigation sought to address those concerns and compensate affected parties.

Who are the claimants in the Plaid litigation?

The primary claimants in the Plaid litigation were Plaid users and customers who believed their private financial data had been inappropriately accessed by the company. The class action lawsuit sought compensation and redress for those affected by the alleged privacy violations.

What was the Plaid settlement payout per person?

Individuals who were part of the Plaid settlement received payments of approximately $35.97 for their share of the $58 million settlement fund. The payments were distributed via inboxes, PayPal accounts, and Venmo statements.

How is the Venmo class action lawsuit related to Plaid privacy litigation?

Though I couldn’t find explicit information linking the two lawsuits, both Venmo and Plaid focus on financial technology and have faced legal actions related to user privacy and data security concerns. As such, both cases highlight the increasing importance of privacy protection in the fintech industry.

- Amazon Email Phishing: How to Identify and Avoid Scams - May 16, 2024

- Malwarebytes vs McAfee: Decoding the Ultimate Antivirus Battle - May 16, 2024

- Best Antivirus for Windows 10: Expert Recommendations for 2023 - May 15, 2024